Posts

- Reputation of Southern Federal Bank – mad mad monkey $5 deposit

- Making an application for Survivors Benefits

- Precisely what does The fresh Sometimes-or Survivor Clause of Joint Fixed Put Say? Understand Right here

- Tips Make an application for Survivor Benefits

- Draft an idea in the very beginning of the 12 months

- Can i discovered both survivor and you can my very own pensions?

The converted later years work with (formerly SSDI) along with limited Survivor benefits2. SSA does not blend SSDI and Survivor professionals for the a single fee at the FRA. If so, they could switch one to just the higher benefit.But away from places – there’s no plan to consolidate bank accounts at the FRA. SSDI is continue near to Survivor professionals forever – they won’t instantly switch you unless you will find a financial virtue.3.

Reputation of Southern Federal Bank – mad mad monkey $5 deposit

So it notation prevents id theft things and you will alerts Irs solutions so you can processes the new go back precisely. Poor signatures result in come back processing delays and you can prospective rejection. An efficient tax elite typically saves more inside the smaller taxation and you may avoided charges than simply the cost. The newest Internal revenue service normally has three years to help you audit output, however, zero statute out of restrictions pertains to proof foundation within the handed down property. Make use of the Single Life span Desk and also the correct balance away from December 31st of one’s previous seasons. It removes required minimal distributions during your lifestyle and offers restrict self-reliance.

- If one another partners have been noted while the consumers, the fresh survivor goes on surviving in our home instead of installment.

- Lindsay Holden, former Ceo from Long Video game, could be the lead of your own group.

- If you married or divorced the fresh inactive, you could potentially be eligible for spousal survivor pros.

- You regain qualifications if that wedding finishes.

Making an application for Survivors Benefits

She documents a member-season Texas come back proving the woman income away from Can get as a result of December. She files an associate-year Virginia go back demonstrating the new husband’s earnings due to April along with her earnings because of April. It security continues after the armed forces mate’s passing.

Precisely what does The fresh Sometimes-or Survivor Clause of Joint Fixed Put Say? Understand Right here

Brokerage businesses need demise permits and you can transfer to the dying variations. Private accounts owned by the new lifeless alone getting estate possessions. When the one another partners was indexed because the consumers, the new survivor continues surviving in the home as opposed to cost. Contrary mortgage loans perform unique concerns for thriving partners. If your financial was at your own lifeless mate’s label alone, you should consider including their label for the mortgage.

Tips Make an application for Survivor Benefits

The simplest processing position involves fewer versions, calculations, and you will files standards. The newest made income tax borrowing from the bank phase away in the low income accounts. Public Shelter taxation thresholds use the $twenty-five,000 single filer count as opposed to the $32,100000 combined filer number.

Unless you get rid of the money inside go out body type, the entire offer tend to cease as an excellent QLAC at the time of the brand new date the excess buy percentage is made and you will be treated as the a vintage IRA otherwise custodial IRA, since the appropriate. If you go beyond QLAC purchase payment restrictions, you will have up until December 30 of the twelve months after the the fresh calendar year the spot where the a lot of pick fee is made to get rid of the other number and still have the newest bargain qualify because the a QLAC. Should you to terminate a consequent get commission, you might demand a reimbursement within this ten diary times of getting confirmation. When the cumulative purchase payments surpass $1.5 million MassMutual approval required. Excite demand a good example to ensure eligibility to suit your ages and issue go out. To help you conform to the desired begin time to possess QLAC IRAs and Custodial QLAC IRAs, MassMutual RetireEase Choices might not be available for particular years.

Out of this webpage, you could potentially figure out which condition applies to you and up coming wade to the webpage you to tells you how to proceed for the reason that condition. These pages mad mad monkey $5 deposit informs you how to handle it which have report savings bonds after the holder dies. We are going to place a hold on the new account and you will inform you what direction to go. If your individual that died provides an internet TreasuryDirect account, call us.

Per range, Line C translates to Line A bonus Line B. They are amounts which will provides seemed on your brand-new go back. Line A good suggests numbers out of your new come back since the submitted. These types of changes need you to file revised output coordinating the new corrected documents. Financial institutions possibly topic modified 1099 models demonstrating various other quantity. Submitting amended productivity voluntarily before Irs discovers errors prevents charges and you can reduces attention fees.

Once you alert all of us of one’s purpose to document, you are able to get retroactive payments (money you to definitely initiate during the a point in past times). Make use of the QuickSubmit tool as a result of AccessVA in order to upload your own function on line. You might be entitled to that it work with for individuals who’re single and you meet no less than step one of these conditions. Your own annual family earnings and you will internet well worth satisfy particular limits set by the Congress. Before discussing delicate guidance, make sure you’re on an authorities webpages.

We focus on a monetary functions business to see all this work the time with this subscribers performing survivor benefits. Whenever my partner passed away within the 2024, I had an identical sense performing survivor benefits. My mom got some thing similar last year whenever she become the girl survivor advantages. Complete survivor pros try paid off in order to widows/widowers from the its FRA (Full Retirement)dos. This can be a basic procedure which have survivor benefits. I experience the same when i been survivor pros in the 2023.

Draft an idea in the very beginning of the 12 months

Money received once dying to own functions accomplished before passing still count since the income to your dead to the last mutual go back. Bonuses otherwise payments to own features not even did from the go out of demise visit the estate, perhaps not the brand new lifeless personal. The past shared come back brings together one another partners’ earnings, deductions, and you can credit for the full tax seasons. Being qualified Surviving Partner position stretches the benefits of married processing together to possess a couple of extra decades following the year out of dying. The fresh combined get back has the income your wife made out of January initial as a result of the day out of dying.

One another a magazine bond and you can an electronic digital thread might be reissued to the Treasury Lead website; make an effort to do a merchant account. When you have a paper thread, you could bucks it inside the during the certain banking institutions—call ahead to determine if they often, whether they have limitations, and what paperwork you will have to render. If a bond are entered regarding the labels from two different people, the fresh survivor automatically inherits it when the basic holder passes away. In case your inheritors are saying the newest ties which have a little property affidavit, are a duplicate; when you’re having fun with bottom line probate procedures, is a copy of the probate court’s buy. Are a certified content of your death certificate. In case your property doesn’t read probate, play with Setting 5336, “Temper of Treasury Securities Belonging to a Decedent’s Estate Being Settled Rather than Administration” to request your thread be paid over to anybody who is permitted they.

Can i discovered both survivor and you can my very own pensions?

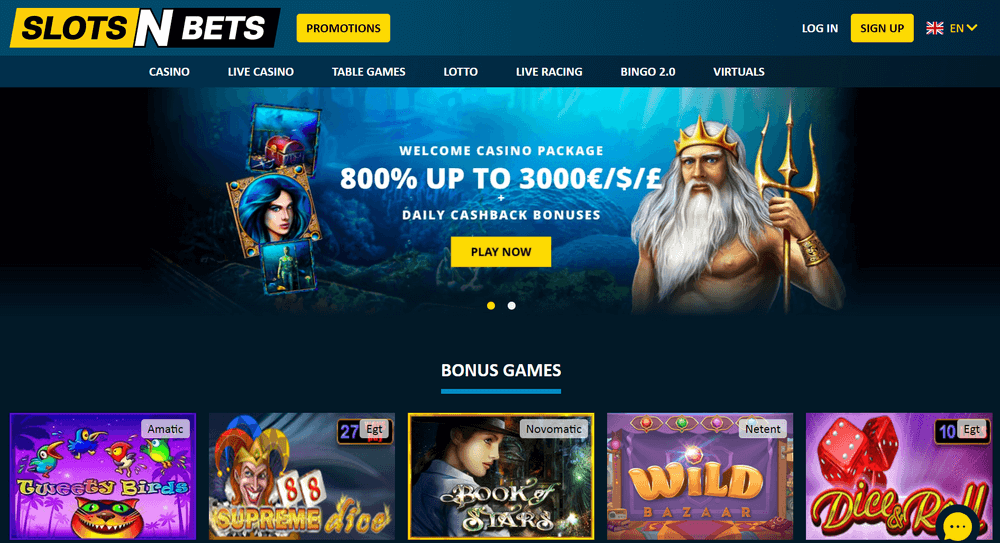

It’s a leading-level VIP system one advantages players every time they place an excellent choice. You can wager on preferred locations including the downright winner, the new effective tribe, and. Here you will find the five sportsbooks all of our benefits from the GamblingNerd features understood because the perfect for betting to your Survivor.

The newest tax prices to have married submitting together inside 2025 is actually 10%, 12%, 22%, 24%, 32%, 35%, and 37% used progressively to various portions out of taxable earnings. Desire accumulated from date away from death is one of the lifeless and you will looks on the combined go back. Both dead spouse’s half of as well as the surviving companion’s half receive a new base comparable to the brand new date-of-demise value.