The Future of Forex Algorithmic Trading: Strategies, Challenges, and Opportunities

The foreign exchange market, commonly known as Forex, is one of the largest and most liquid financial markets in the world. With an average daily trading volume exceeding $6 trillion, traders are constantly seeking ways to enhance their trading efficiency. One of the most revolutionary advancements in this domain is algorithmic trading. This approach leverages computer algorithms to execute trades based on pre-defined criteria, enabling traders to capitalize on market opportunities far faster than manual execution can allow. For more insights and resources, visit forex algorithmic trading Trading Asia.

Understanding Forex Algorithmic Trading

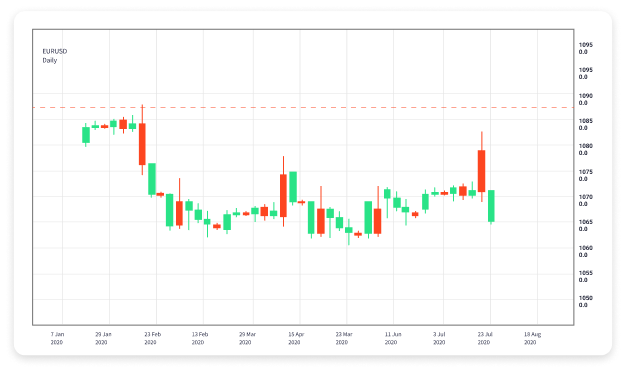

Forex algorithmic trading is a method of using algorithms—sets of rules and calculations—created by traders and programmers to make buy and sell decisions on the currency market. These algorithms can analyze multiple market factors simultaneously, perform calculations, and execute trades automatically. By removing emotional biases from trading decisions, algorithmic trading helps traders stick to their strategies based on statistical analysis and real-time data.

Key Components of Forex Algorithmic Trading

There are several essential components that contribute to effective algorithmic trading in the Forex market:

- Market Data: Accurate and real-time market data is crucial. Algorithmic traders must have access to reliable data feeds that provide price quotes, order book information, and other relevant market signals.

- Trading Strategy: Developing a robust trading strategy is fundamental. This includes defining entry and exit points, risk management parameters, and position sizing. Successful algorithms often utilize technical analysis, statistical arbitrage, and market sentiment analysis.

- Execution System: A trading algorithm needs an efficient execution system to place orders. This includes platforms that allow for fast and reliable trade execution, often with minimal slippage.

- Backtesting Environment: Before deploying an algorithm in live markets, it must be rigorously backtested using historical data. This process helps traders understand how their strategy would have performed under various market conditions.

The Benefits of Algorithmic Trading

The advantages of employing algorithmic trading in the Forex market include:

- Speed: Algorithms can process information and execute trades at speeds unattainable by human traders. This speed enables traders to take advantage of fleeting market opportunities.

- Accuracy: Automated trading systems can minimize the potential for human error. When implemented correctly, algorithms execute trades exactly as programmed, adhering to predefined rules.

- Backtesting and Optimization: Traders can test their algorithms against historical data to assess viability before deploying them in real-time environments.

- Diversification: Algorithms can simultaneously monitor multiple currency pairs and take advantage of diversification which can lead to reduced overall risk.

Challenges in Forex Algorithmic Trading

Despite its numerous advantages, Forex algorithmic trading is not without challenges:

- Market Conditions: Sudden changes in market conditions, such as unexpected news releases or economic data, can lead to poor performance of an algorithm if it is not designed to adapt to such changes.

- Overfitting: Traders must be cautious of overfitting their algorithms to historical data, which can result in models that perform poorly in real-time trading.

- Technical Issues: Technical failures such as internet outages, server crashes, or software bugs can disrupt trading and lead to significant losses.

- Regulatory Risks: As regulatory environments evolve, algorithmic traders must stay informed about compliance requirements impacting their trading strategies.

Opportunities Ahead

The future of Forex algorithmic trading is bright, with several key opportunities on the horizon:

- Artificial Intelligence and Machine Learning: The adoption of AI and machine learning techniques in algorithmic trading is revolutionizing Forex trading strategies. These technologies can help develop more sophisticated models that adapt to changing market conditions and improve predictive accuracy.

- Increased Access: More retail traders are gaining access to algorithmic trading tools and platforms, leveling the playing field with institutional traders.

- Integration with Blockchain: The intersection of blockchain technology and Forex trading may lead to new opportunities for transparency, efficiency, and security in algorithmic trading.

Conclusion

In summary, Forex algorithmic trading represents a significant advancement in the trading landscape. While it offers numerous benefits such as speed and accuracy, traders must also be vigilant in addressing the challenges that come with it. By understanding the intricacies of algorithmic trading and evolving with technology, traders can position themselves for success in this dynamic market. As trading methodologies continue to innovate, embracing algorithmic trading can be a crucial step for any trader aiming to thrive in the Forex ecosystem.